The Digital Race is on. Win as a Digital Leader.

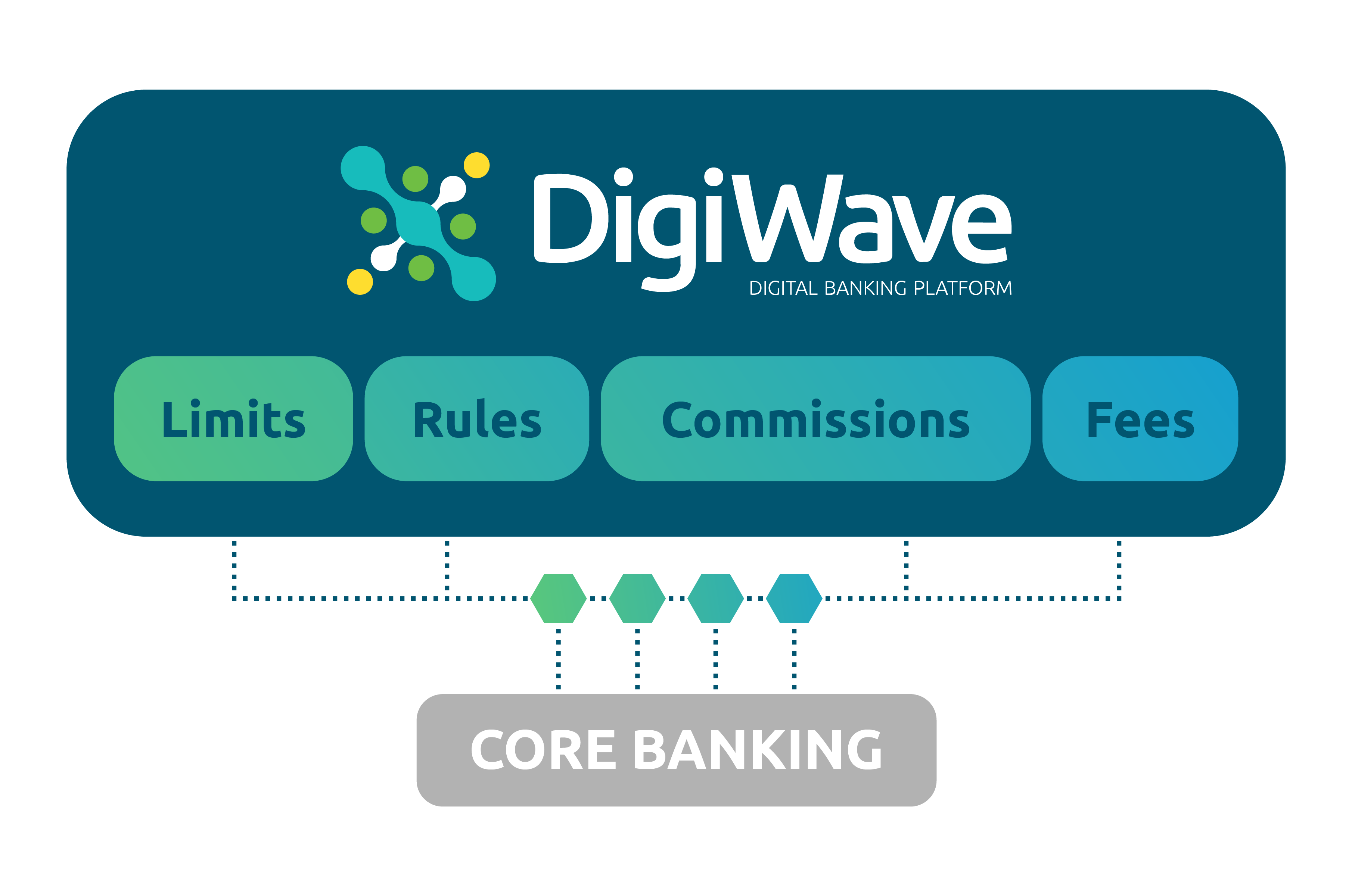

DigiWave Digital Banking Platform helps financial organizations accelerate time to market today and be ready for tomorrow. It provides the foundation for digital transformation, the capabilities for exceptional omni-channel experiences, and the technology to leverage open banking and new ecosystem models at their best. Deployable on-premise or in any public or private cloud.

Why Choose DigiWave Digital Banking Platform?

The DigiWave Platform at a Glance

Today's customers demand seamless experiences at any touch point. Meanwhile, too many financial organizations struggle to execute on their digital strategies. The DigiWave Platform is here to help you move fast in the digital era.

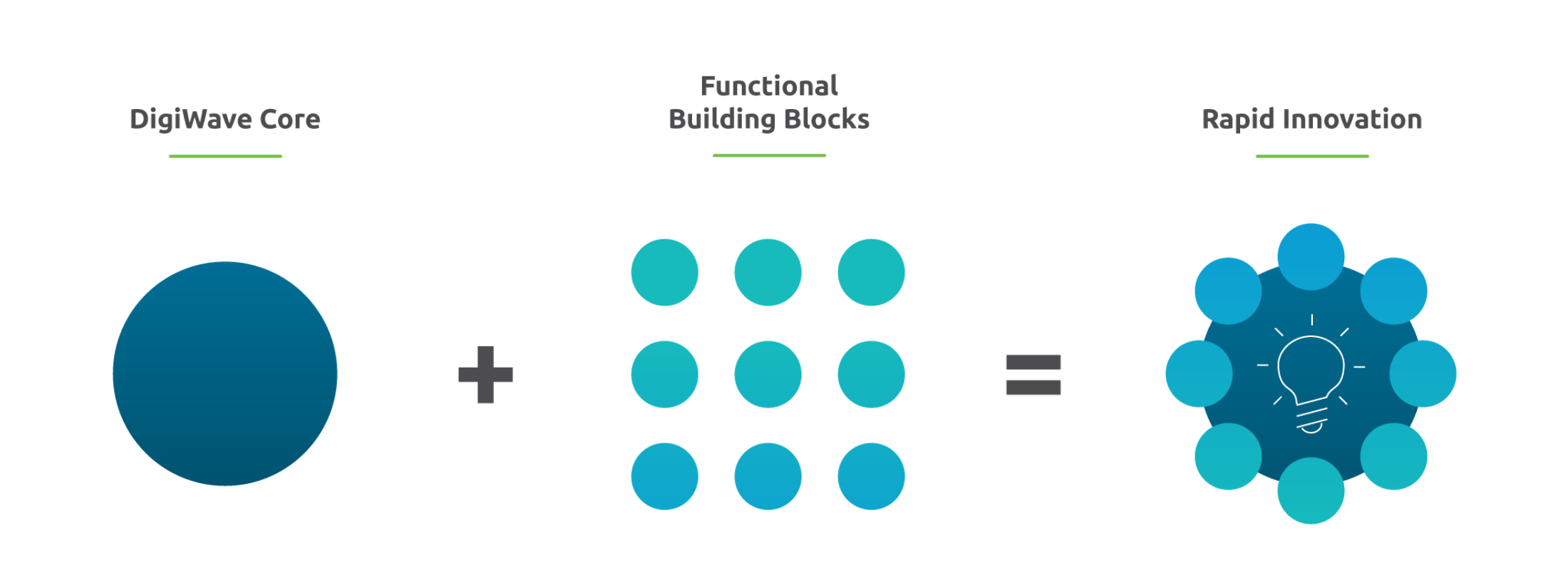

The Concept Behind DigiWave - Flexibility

Why a platform is a key advantage for your success in the digital era

DigiWave modernizes your existing architecture with a mature platform core, which you can flexibly extend with modular building blocks. The result - customer-centric digital financial solutions that are rapidly launched, smartly reused, integrated across channels, and effortlessly scaled with any new digital initiative in your roadmap.

Mature Digital Platform Core

Connects and transforms your business into a digital bank. The foundation of a future-proof digital journey.

Configurable Building Blocks

The ready digital banking capabilities your need to accelerate digital financial products and services to market

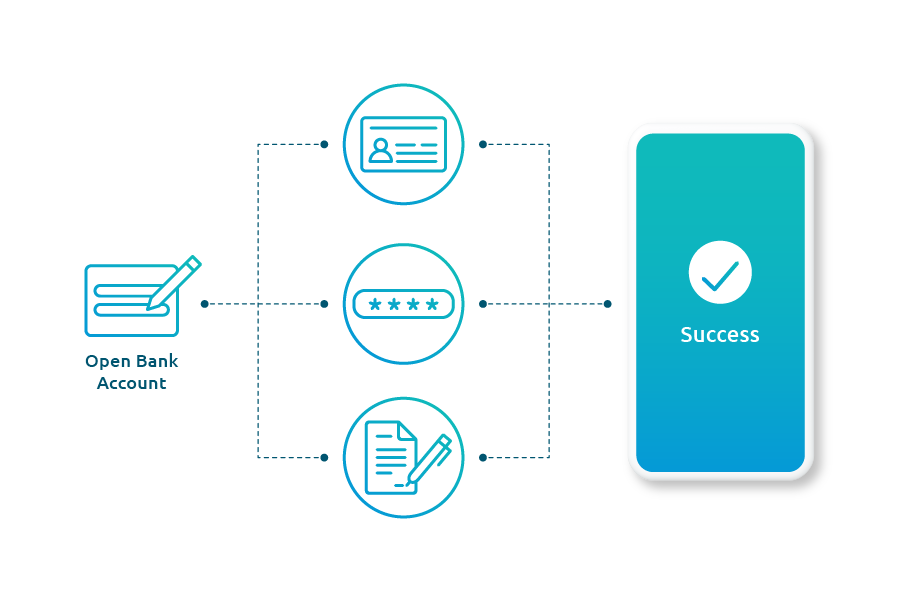

Digital Customer Onboarding, Account Opening & Product Origination

Achieve higher onboarding conversion rates. Grow share-of-wallet with seamless origination. Improve the security, quality and accuracy of document and data capture.

- Onboarding and origination within minutes: entirely digital & paperless or hybrid; self or assisted; fully configurable.

- State-of-the-art UX and UI

- Multi-factor authentication

- Visual Application Form Configurator

Secure Authentication & Identity Management

Provide convenient and secure identity verification across channels. Reduce fraud and know who your customer is.

- PSD2-compliant Strong Customer Authentication (SCA) and Consent Management

- Biometrics, e-Signature, OTP, integrations with National ID Registries and more

- Pre-integrated with market-leading IAM providers

- Ability to embed any third-party KYC technology via APIs

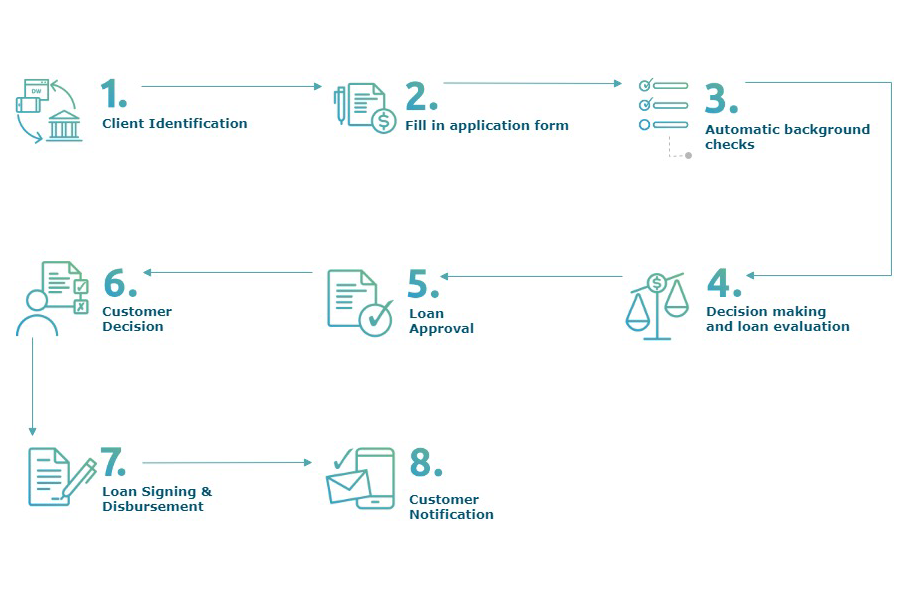

Workflow and Task Management

Flexibly configure the workflows for your business and your way of working

- Visual Workflow Editor and standard BPM templates for customer onboarding, account opening, loan origination, etc.

- Fully customizable performance and task management to dramatically improve workplace productivity

- Complaint management

Open Banking Capabilities

Leverage the open banking opportunity to improve customer experience, secure customer ownership and add new revenue streams

- Integrate with your value-chain partners to offer both financial and non-financial services

- Be close to your customers every day - in their hands and their pockets, as well as integrated in key touch points, e.g. portals, partners.

- Comply with PSD2 through an integration platform with an API Gateway, SCA and Consent Management

- Reduce IT delivery times thanks to a 3rd Party Development Portal and a Sandbox

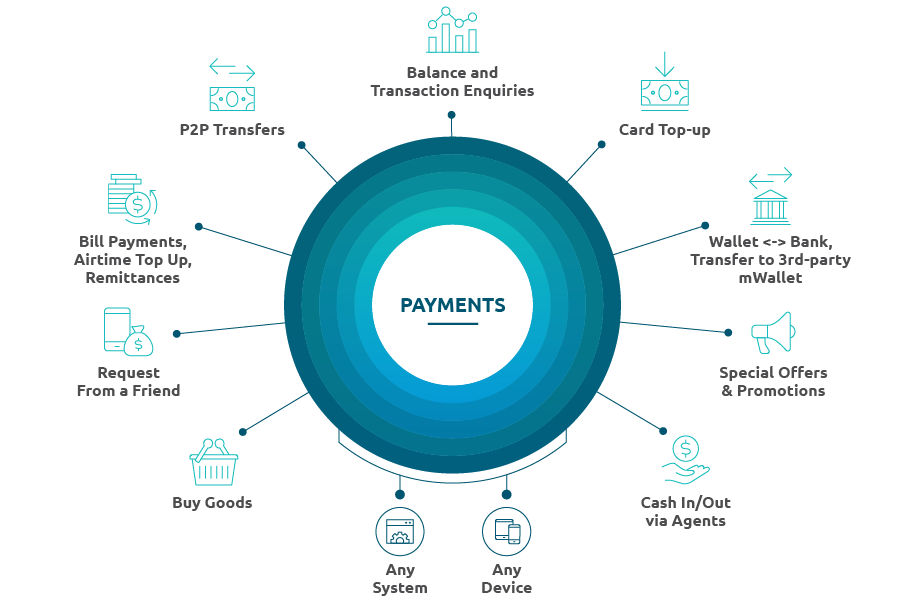

Full Spectrum of Payments

Faster payments means more revenue and delighted customers. Seamless payment processing is at the heart of the DigiWave Platform.

- Support for different types of transactions and funds transfer

- Robust payments engine with transaction authorization and reconciliation

- Availability even if CBS and/or other systems are down.

Flexible Digital Products Creation

Create tailored digital products to respond to ever-changing customer needs. Use fees, commission splits, limits and other business rules. Sync with any core banking or insurance system.

- Loans: Shorten loan TAT and lower delinquency with targeted offers and efficient credit decision processes. Supercharge with analytics and AI to automate loan renewal and offer intelligent nano-loans.

- Savings, Deposits, Current Accounts: Quickly launch new product variations for targeted customer segments.

- Cards: Issue credit, debit, and pre-paid cards, both personalized and pre-printed.

- Insurance: Offer digital insurance policies, sold through digital self-service or via agents/ brokers; manage policy and claim lifecycles end-to-end.

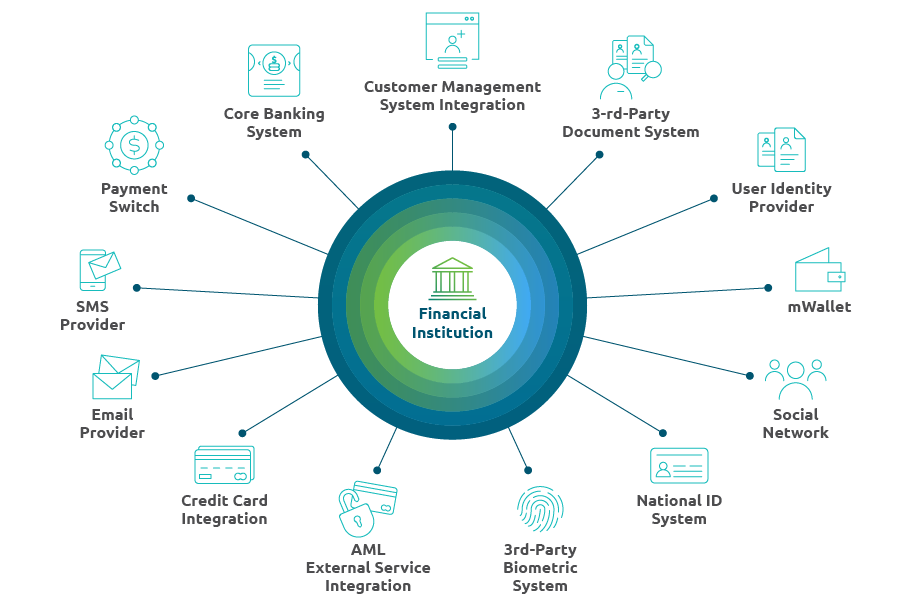

Powerful Integrations

Extend DigiWave with any third-party solution. Pre-integrated with the best-of-breed vendors for biometrics, tokenization, and more.

- Embed any third-party solution or service into your processes (identity verification, facial recognition, PFM, credit scoring, etc.).

- Leverage an Enterprise Integration Layer to modernize legacy architecture, reducing TCO. Reuse IT assets across workflows.

- Unify customer data across channel silos for omni-channel experiences and 360-degree customer views.

Virtual Cards & Tokenization

Offer modern, low-risk, high-gain payment instruments.

- Virtual Cards: Acquire new customers quickly at a low risk by issuing virtual cards. Then upsell with more products to increase customer value.

- Tokenization: Tokenize existing and new physical and virtual cards for the purpose of secure NFC payments thanks to our partnerships with market-leading providers.

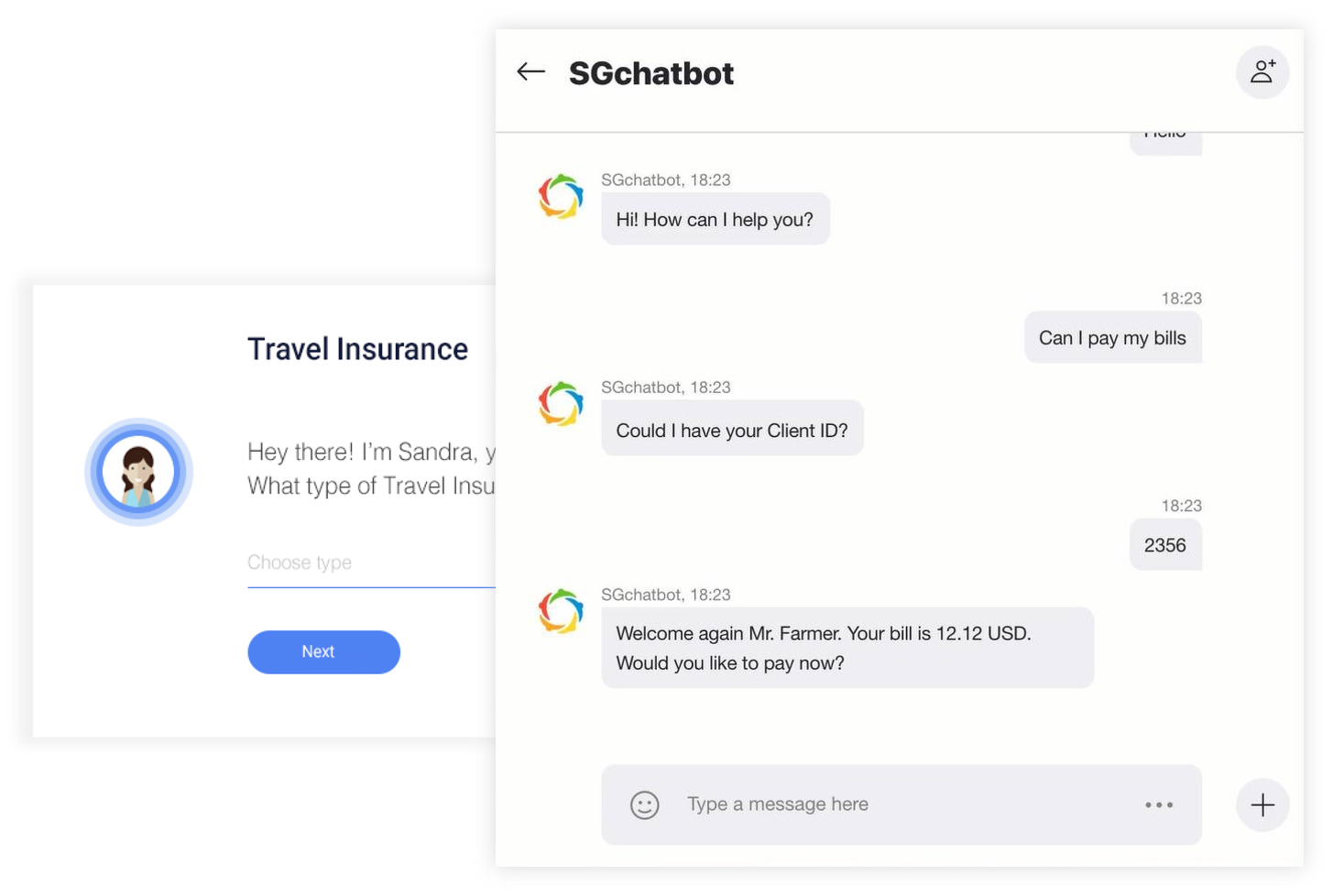

Chatbots & Conversational Banking

Take customer experience to the next level through custom AI-powered chatbots for banking, insurance, telcos, and more.

- Reduce customer service costs while boosting digital engagement.

- Implement chatbot interfaces in your existing digital channels.

- Convert leads to customers right within social messaging apps (Viber, Skype, Facebook Messenger).

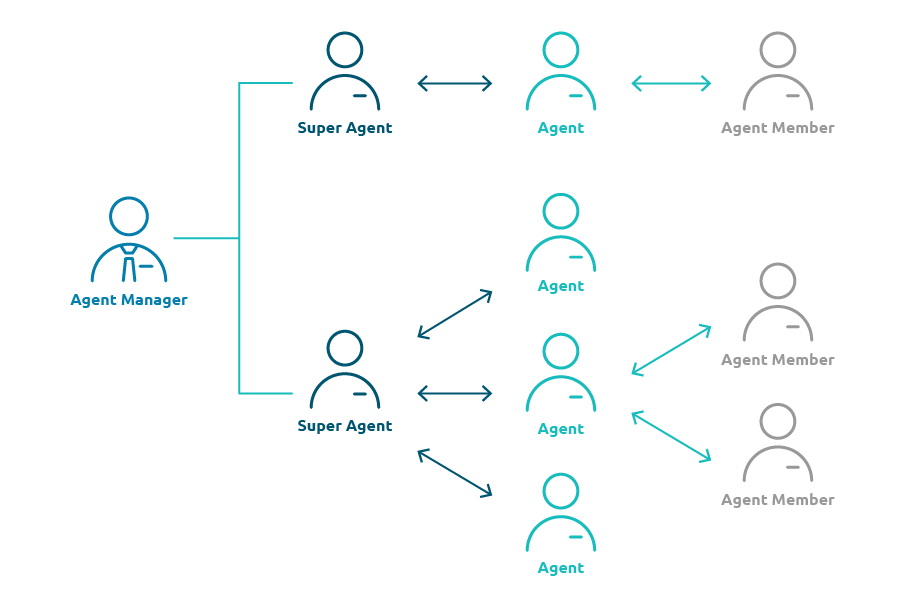

Field Staff/ Agent/ Merchant Management

Ensure the efficient performance of your network operations

- Flexible agent/ merchant hierarchies and roles

- Configurable rules for commission sharing

- Mobile onboarding for agents/ merchants

- Performance Management

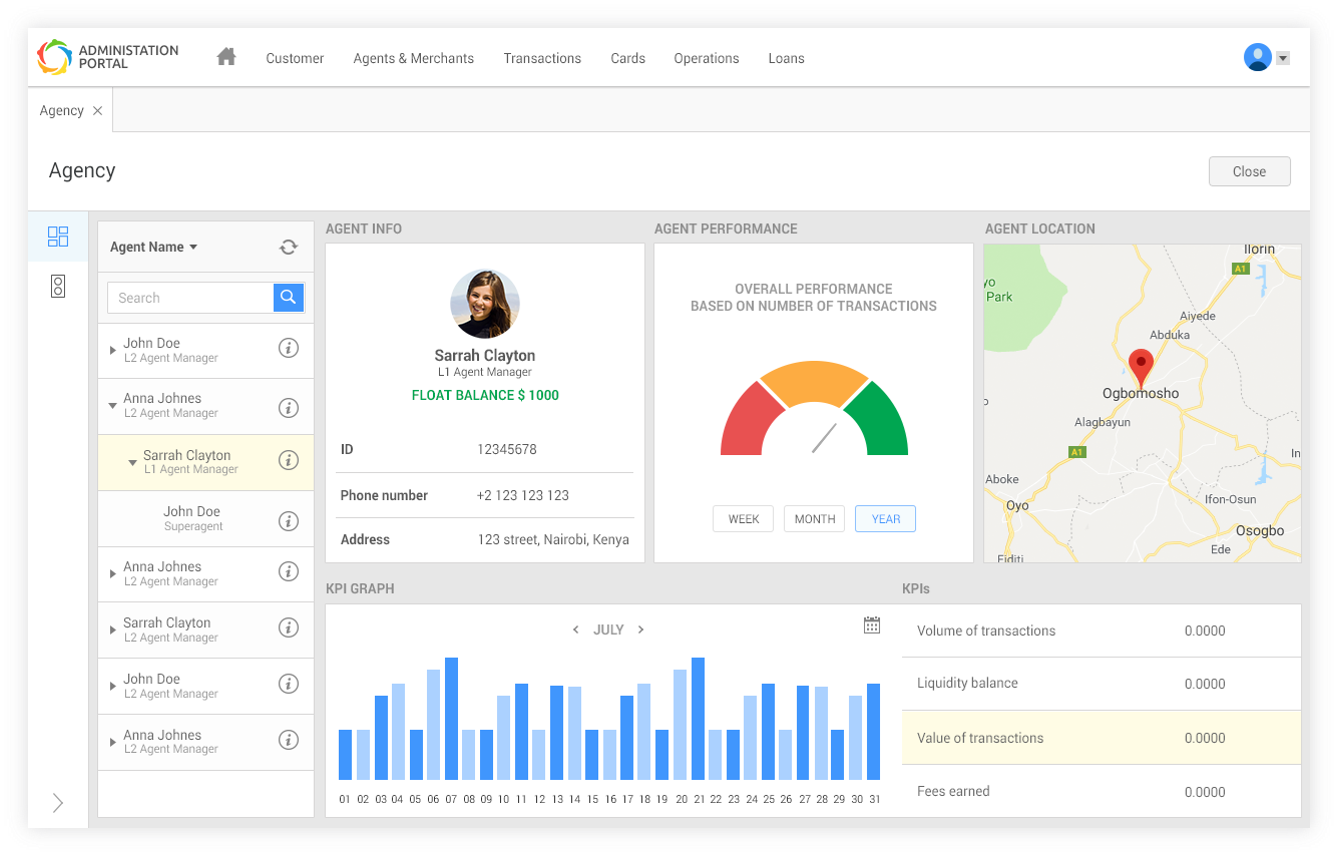

Reports & Dashboards

Understand customer behavior across channels, optimize team and agent network performance

- Focus on improving customer relationships via 360 views across financial products.

- Upsell and cross-sell the right products to the right customers. Create AI-driven offers based on behavior, such as automated nano loans.

- Integrate your existing and future analytics, business intelligence or AI solutions.

UX & UI Design Expertise

Leverage our Design team’s experience in creating compelling cross-channel customer journeys.

Deliver customer-centric digital financial products and services. Blend the physical and digital worlds to become your customers' 'everyday bank'.

We speak mobile-first and help you extract the most customer value from digital.

Move Even Faster with Prebuilt Digital Solutions

Learn more

Lead in the Digital Era

Accelerate time to market today and be ready for tomorrow with the DigiWave Digital Banking Platform.