The Benefits of Internet and Mobile Banking

Fast, Customer-centric, Anytime Banking

Internet and mobile banking solution that meets modern customer expectations

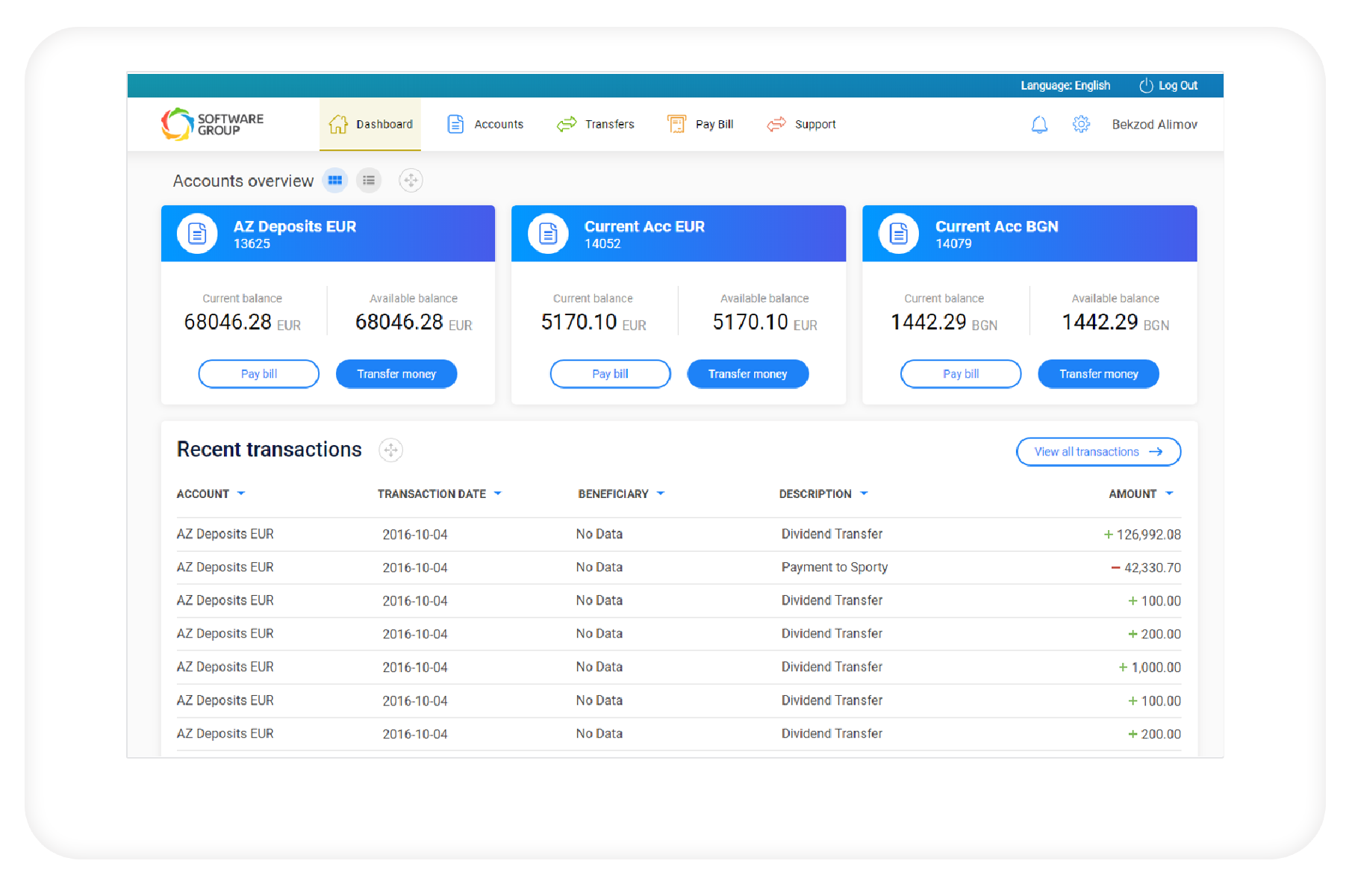

Exceptional self-service banking

Position your bank at the center of customers' lives. Provide digital-first experience for web and mobile.

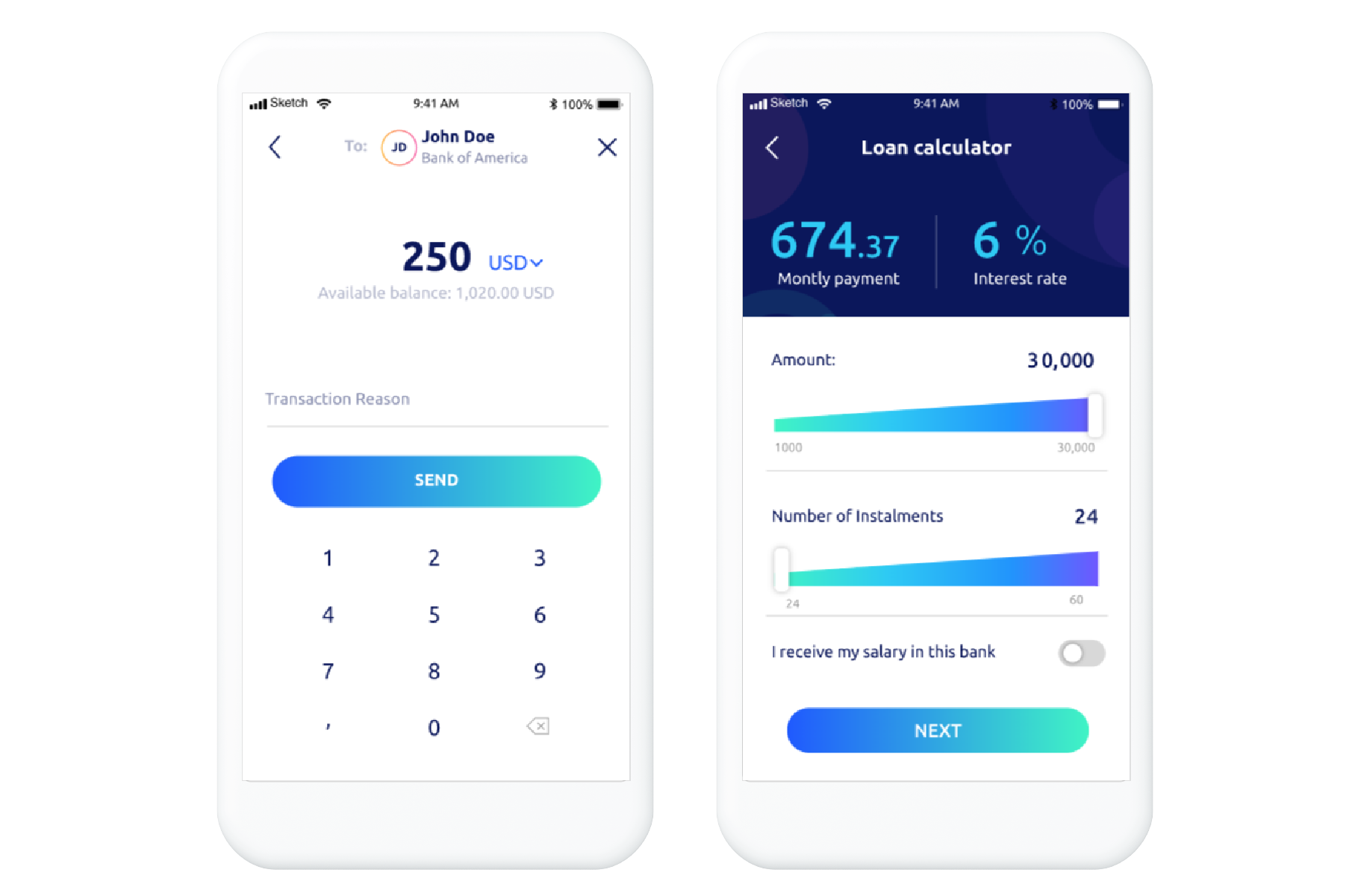

Mobile banking app for iOS & Android

Empower customers to manage their finances from anywhere - accounts, deposits, loans, transfers, etc.

Self-registration for Web and Mobile

Entirely self-service onboarding, done within minutes. Seamless multi-factor authentication and document capture.

Remote Account Opening, Loans & Cards

Support for current, savings, deposit, loan accounts, etc. Digital loan origination and repayment. Quick card management on the go.

Rich set of transactions

Intrabank fund transfers, standing orders, transfers to other banks, international payments, transfer to mobile wallets, bulk payments, bill payments, and more.

Multi-factor authentication

Biometrics, PIN, OTP, eSignature, strong customer authentication (SCA) with embedded software token, any third-party service integration.

Smart alerts and notifications

Helping your customers stay on top of their finances via event-based push notifications, SMS and email alerts.

Customizable to your brand

Offers fast-loading, intuitive UX and fully customizable branding, based on your vision and needs.

Ready for the Future of Banking?

Become your customer's "everyday bank". Leverage the opportunities of Open Banking.

Open Banking Capabilities

Open banking is no longer a question of IF, but a question of WHEN for banks. You need to choose your path - remain a utility or transform into an "everyday bank".

- Enrich your Internet and Mobile Banking Solution with open banking capabilities through our Enterprise Integration Platform

- Comply with PSD2 with an API Gateway, SCA and Consent Management, and more

- Integrate with your value-chain partners to offer both financial and non-financial services

- Be close to your customers every day - in their hands and their pockets, as well as integrated in key touch points, e.g. portals, partners.

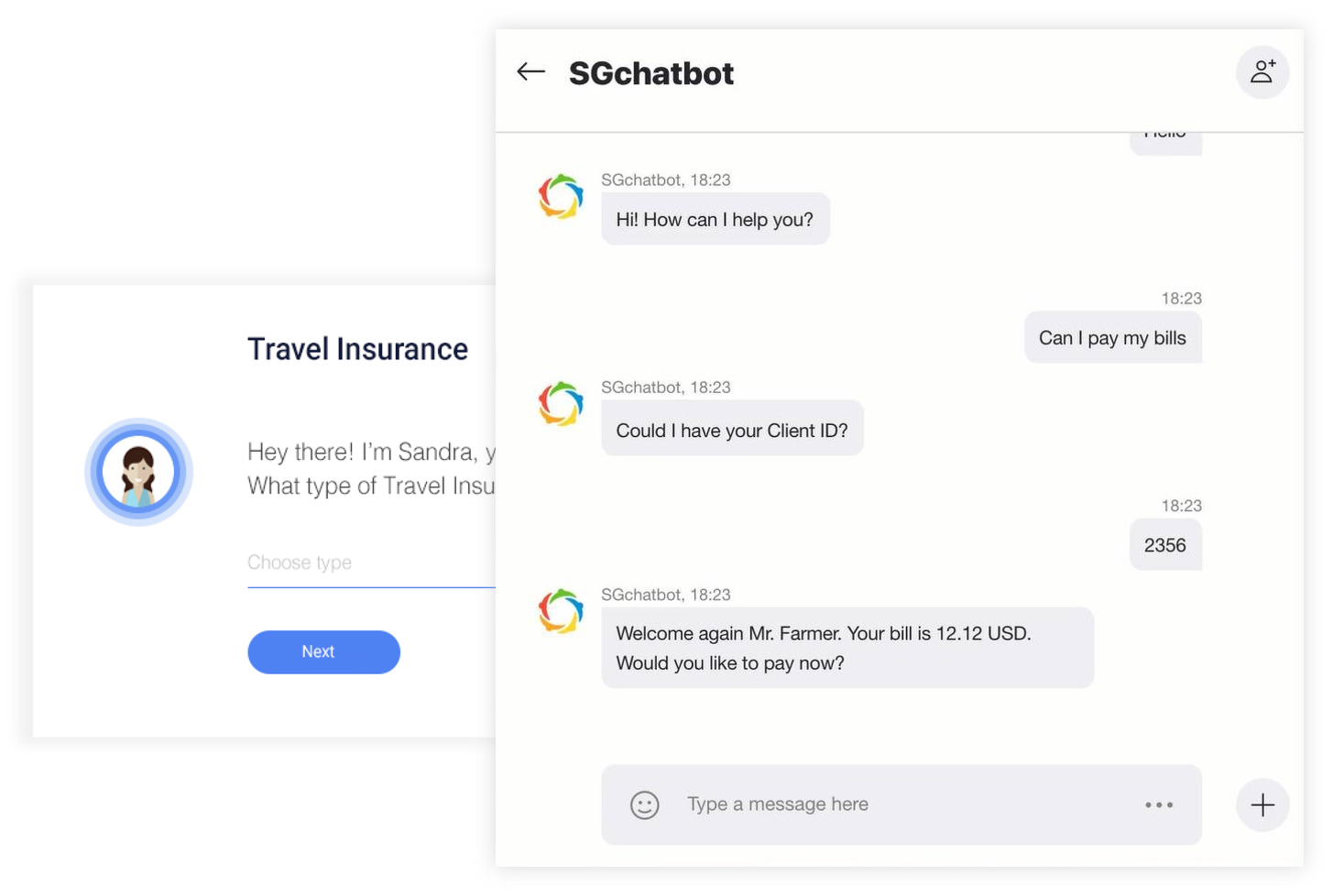

Chatbots & Conversational Banking

Take customer experience to the next level through AI-powered chatbots for banking.

- Integrate chatbot interfaces with your Internet and Mobile Banking channels

- Reduce customer service costs, while boosting digital engagement

- Convert leads to customers right within social messaging apps (Viber, Skype, Facebook Messenger)

UX & UI Design Expertise

Deliver customer-centric digital financial products and services. Blend the physical and digital worlds to become your customers' 'everyday bank'.

We speak mobile-first and help you extract the most customer value from digital.

Powered by a Digital Banking Platform

Our solutions are built on the DigiWave Platform, making for quick launch to market, easy scaling, and cross-channel workflows.

Fast time to market with digital initiatives

Respond to ever-changing customer needs and stay ahead of the competition. Leverage out-of-the box building blocks, such as digital onboarding, payments, and more.

Configurable forms and cross-channel workflows

Easily configure your own or use out-of-the box onboarding and origination forms, KYC and business process workflows.

SEAMLESS INTEGRATIONS

Reuse existing architecture, connecting everything. Unify customer data across silos. Reduce TCO. Connects with any third-party system.

Future-proof, scalable platform

Scale the platform gradually thanks to its open, modular architecture (microservices, APIs). Extend with new digital solutions and third-party services (insurance, PFM, remittances, etc.).

24/7 Service Availability with Frictionless Payments

Faster payments mean more revenue. Handle vast amounts of data and process thousands of transactions per second. Deliver frictionless service in both mature and developing markets.

Centralized Management. Multi-country. Multi-tenant

Manage all your digital channels from a central space. Define flexible user roles and permissions. Easily set transaction fees, commissions and rules.

Why Choose Software Group?