With a genuine mission of providing the people of the Kyrgyz Republic with modern and advanced financial solutions, KICB became the first bank in the country to launch a mobile wallet in 2014. But its quest for innovation didn’t stop there.

KICB saw the need to replace its existing wallet with a more modern and advanced Mobile Wallet, specifically designed to suit the needs of a market with a large millennial population.

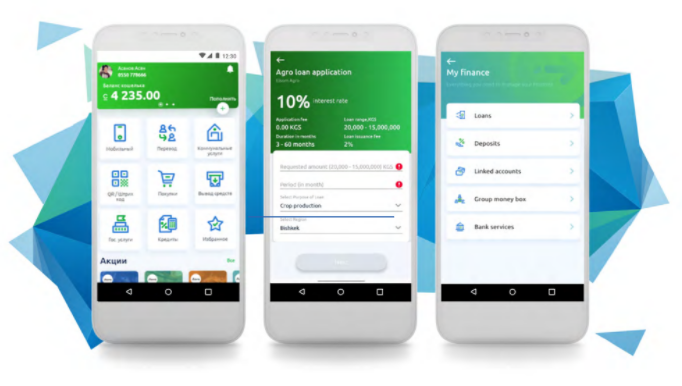

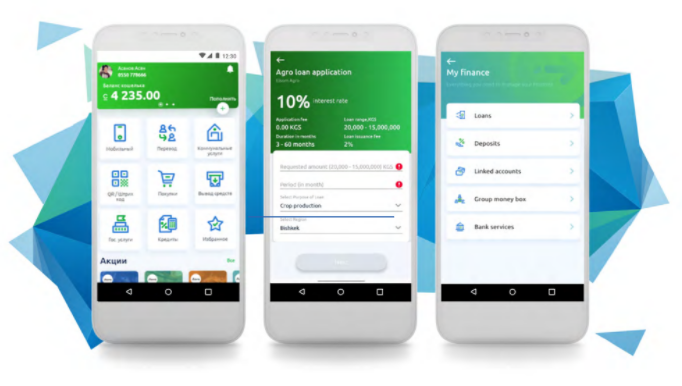

The bank’s objective was to allow clients to reap the benefits of an omnichannel payment experience in a single wallet, with options such as P2P payments, contactless payments, digital and nano loans, savings, airtime top-up, and more.

However, a project of this scope required a dramatic shift and migration from an old organization to a new one with zero data loss and undisturbed operations.

To achieve its ambitious goals, KICB chose Software Group as the partner that offers a robust and

flexible Mobile Wallet platform that adds value and convenience for people, and further allows for the creation of an ecosystem that connects different players, such as banks and third-party payment partners.

The Elsom Wallet with unique possibilities

Today, a project that started in 2019 is a reality that brings forward a new world of opportunities for KICB. By 2021, the Elsom wallet already had close to half a million registered users that make over 600 000 transactions per month.

Download the case study to learn more about the Elsom Wallet!

Download the case study to learn more about the Elsom Wallet!