Today, the best-in-class digital banking services are those that balance innovation, convenience, and human-centricity to ensure frictionless financial life management for their customers via any device.

Banks need to be able to respond to any life situation with fast and convenient digital products - from helping customers manage their day-to-day finances to supporting them with access to digital loans during the COVID-19 crisis.

But how can you drive customers to choose your digital banking solutions over competitors’?

You have to compete not only with other banks, but also with Fintechs and Big Tech giants who have started stepping into consumer finance, promising high-standard web and mobile financial services.

How fast can you adapt to changing consumer expectations?

It is a challenging time for banks to stand out in the “we-too” online space. But differentiation is possible if you can craft and personalize your products and support them with exceptional digital experiences.

In this post, we will guide you through the key digital banking features, technologies, and services you should consider if you want to provide next-gen customer experience as a key differentiator.

1. Simple Self-Registration

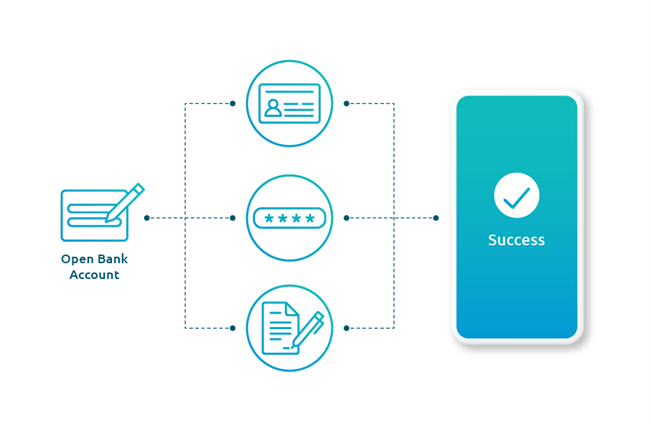

A digital self-onboarding process allows the customer to register for bank services (such as opening an account) on their own regardless of the device.

However, especially when bringing a new client, the bank should collect and validate customer information, verify documents, ensure legal aspects coverage, and perform due diligence, adhering to regulations.

All of this should be completed digitally in 4-5 simple steps. A lengthy process with inadequate guidance could cause time-consuming onboarding which can result in an unsatisfactory digital banking service.

Providing a seamless self-registration process is the bank's chance to make an exceptional first impression and win the digitally-savvy customers.

Time-saving tools like machine-learning-based Optical Character Recognition (OCR) and trusted remote ID verification services help automate parts of the onboarding process while delighting customers with their convenience.

2. Remote Account Opening in Under 5 Minutes

This digital banking service not only makes life easier for your customers. It can also be a criteria for customers to switch between banks.

According to a survey by OneSpan, 68% of the respondents (banks and financial institutions) are working on implementing digital account opening in 2020. Moreover, 35% say it is a top priority because they risk losing customers if they do not offer it.

Still, many people struggle to open a bank account completely online.

The key reasons that make applicants abandon a digital account opening process are: lengthy application (28%), too many channel interactions (18%), poor customer experience (13%).

Obviously, there is room for improvement and an opportunity to stand out with an effective and smooth customer experience.

Digital account opening is most often the immediate step after self-registration. The end-to-end process needs to be perfectly synchronized while simplifying all steps - from capturing customer data to choosing the type of account.

People should be able to onboard themselves and open an account with just a few clicks in under 5 minutes, which is considered a best practice for digital customer onboarding.

3. Loan Application In A Few Clicks

Loans are a core banking service, so transforming digital loan application into an automated and effortless process is a must.

Personal loan applications should be performed within a few clicks on the customer device of choice with the time to approval and getting the cash happening in less than 24 hours.

When developing a digital lending strategy, consider key features such as:

-

Core banking system integration, eliminating the need for a client to provide information that is already on your system

-

Omni-channel borrowing experience

-

Opportunity for the customer to capture documents without leaving the mobile app or web

-

The ability to save a loan application at any point and reopen it at a later time

-

Availability of eSignatures

-

Remote consulting via video chat or chatbot

4. Instant P2P Payments

P2P (Peer-to-Peer) is thriving in today’s banking environment. It is a simple payment solution that allows users to send money instantly from any device.

Using a linked bank account, a credit/debit card or a wallet stored-value account, users can comfortably transfer money to friends and family from their phone or computer in a tap or two.

When it comes to customer convenience and simplicity, P2P is a hard-to-beat functionality that fits great with an increasingly mobile-first society where financial services are expected to happen in real-time.

P2P transfers should be backed by a high degree of security and proper protections against fraud, such as biometrics, PIN, or OTP (One Time Password).

5. Refined Bulk Payments

Bulk payments are mainly used by banks’ SME and corporate customers, allowing them to make money transfers to multiple beneficiaries from a single account at once.

These payments are extremely convenient for business transactions, such as salary payments, paying contractors, suppliers, dividends, and even for government transactions like pension payments and cash aid disbursements.

Make sure your bulk payment capability provides a high level of security, a good number of settings and options, and easy upload of data files.

You should aim to offer digital bulk payments that are a fast, easy, and efficient way of sending money to multiple people/organizations.

6. Automatic Bill Payments

Bill payments are a recurring monthly activity for both business and individual banking customers and one of the grounds where automation is already bringing convenience.

Any modern digital banking service allows customers to connect billers directly to their accounts/cards and pay all bills from a centralized place either manually or a scheduled on-time automation.

Empower your customers with an extensive set of administration features such as fast access, control over bills, seamless integration with other systems, real-time overview, and report generation.

7. Feature-Rich Card Management

Customers always demand greater control of their financial life and card management is no exception. You can enhance digital card management with easy-to-use features to empower your customers.

For example, you can enable card users to easily set up alerts for purchase limits. Or you can prompt customers to ensure card security with regular PIN changes.

The variety of features that can improve digital card management is growing. Here are some other key capabilities:

-

Lock and unlock options

-

Set up of automatic payments

-

Applying for a new card easily online

-

Requesting credit limit increase online

-

Setting transaction limits

-

Locking card transactions by country

8. Mobile Contactless Merchant Payments

Mobile contactless payments are a hot digital banking service and the COVID-19 outbreak has accelerated them even further. Retailers are developing measures that limit the physical contact with surfaces and the use of cash.

Mobile contactless payments allow customers to simply tap their smartphone onto a POS terminal (or other free-of-touch readers) to pay. It is a fast, convenient, and secure payment solution for both customers and merchants.

The most common technologies that power contactless payments are Near Field Communication (NFC) and QR codes.

Mobile devices provide a variety of security measures to support contactless payments, such as a unique code that proves the device is genuine, the use of tokens instead of card data, and biometric technology.

The increased use of mobile payments provides banks with the opportunity to extend their offering with value-added services, such as loyalty schemes, scanning coupons in-store, GPS alerts, and more.

9. Highest Level Of Security

Digital banking services should balance convenience with security.

Banks need to implement cutting-edge technology and industry best practices to build security into every step of their internet and mobile banking solutions, wallets and other digital channels. These include features and measures like:

-

Biometrics

-

Out of band authentication (login notifications, ATM withdrawal alerts)

-

Device management

-

Card tokenization

-

Data encryption

-

Two-factor authentication

-

Transaction confirmation via OTP

-

Fraud detection system

-

eSignatures and PKI

10. All Types Of Notifications

Alerts and notifications enable customers to stay on top of their financial activities.

Notifications not only give customers account information when they need it, but also guard against fraud and theft.

Especially useful for customers are the real-time banking alerts that notify them via mobile when their account balance goes over a set amount.

Other types of online and mobile banking notifications include:

-

Withdrawal confirmation

-

International transaction notifications

-

Purchase alert

-

Overdraft protection notice

-

Payment reminders

-

Deposit confirmations

-

New bank services notifications, etc.

11. Digital Insurance (Bancassurance)

A new wave of converged financial services has been rising. Many banks are taking the path of an ecosystem aggregator, complementing banking with additional financial and non-financial services.

Digital insurance is one value-added solution which can help you differentiate from the crowd.

Offering easy-to-access, personalized digital insurance increases customer satisfaction and improves customer health and wealth management while generating new revenue for the bank.

A good digital bancassurance solution includes options for buying different insurance products and seamless access to claims management via mobile or web.

12. Personal Finance Management (PFM)

When choosing a bank, customers would certainly lean towards the bank which can help them meet their money goals better and make healthier financial decisions.

This is where PFM functionalities come into place as a differentiating point for banks over competitors. PFM encompasses all digital tools that allow customers to manage their financial life.

An advanced PFM solution includes features, such as budgeting, transaction categorization by merchant type, spending and saving goals, a real-time view of account balance, and visual charts on spending habits.

13. A Variety Of Loyalty Programs

Customers love and seek loyalty cards and coupons to save money, feel rewarded or be a member of an exclusive community.

Many even pick certain wallet or card offerings based on the rewards they will get.

Digital loyalty strategies can be a powerful competitive advantage for your bank helping you retain customers and creating brand loyalty.

To create a successful digital loyalty program, you need to consider a number of items:

-

Omnichannel access

-

Wide variety of rewards (points, vouchers, cashback, etc. )

-

Personalized offers

-

Real-time updates of the offers and deals

-

Notifications to let users know about new deals

-

Location awareness to reach the customer in the right place

14. Advanced Settings

To give customers more control over their internet and mobile banking, wallet or another digital banking experience, you can provide more advanced management features.

For example, you can allow customers to change their passwords, card PINs, view transaction history, display last login details, or decide what they would like to see in the home screen of their mobile wallet or banking app.

Ensure that each activity is seamless, convenient, and that it provides customers with flexibility and refined control.

15. Smart Chatbot

In recent years, chatbots in banking are enjoying increased demand and adoption, empowering customers with seamless self-service.

Chatbots have the ability to respond to general requests, reducing customer service costs and can engage and delight customers via any channel - your website, mobile banking app, Facebook messenger, etc.

Furthermore, a chatbot can act as a personal financial assistant that helps customers perform activities like checking a balance or making a loan enquiry.

Whenever human assistance is needed, the chatbot can easily route the conversation to a bank agent who can conveniently continue serving the customer case via video conferencing.

How Can Software Group Help You Provide Best-In-Class Digital Banking Services?

Blending our customer focus, industry-leading technology solutions, and over 10 years of experience driving digitalization, we've created DigiWave Digital Banking Platform which enables financial institutions to deliver next-gen omni-channel customer experiences.

Led by microservices and APIs, DigiWave comes with configurable digital banking capabilities, such as onboarding & origination, multi-factor authentication, identity management, forms, workflows, payments, integrations, and prebuilt digital solutions - Mobile Wallet, Agency Banking, Internet and Mobile Banking, and more.

Easily integrated with any core banking system, our solutions help financial organizations accelerate time to market today, achieve fast ROI, and stay on top of the digital revolution tomorrow.

What is the next initiative on your digital agenda?

Let us guide you on your road to digital leadership. Talk to our experts today.

Sources:

OneSpan - The State of Digital Account Opening Transformation 2020