In the rapidly evolving landscape of financial services, agency banking has emerged as a strategic cornerstone for banks aiming to extend their reach beyond branches. While in many markets telcos are still leading the charge in agent banking, traditional banks are reinventing their approaches to innovate and reclaim market share.

In the last few years, agents have been transitioning from a peripheral distribution channel to a pivotal player in a comprehensive financial ecosystem. This has opened up the door to new opportunities for banks to adopt innovative strategies that maximize the profitability of their agent banking networks.

In this blog, we delve into the strategies driving the transition to Agency Banking 2.0, a transformative approach that merges agents, merchants, and the entire value chain, outlining actionable tactics for banks to bolster their agent network profitability and seize leadership in the market.

Strategy 1. Integrate Merchant and Agent Channels

Traditionally, banks have managed merchant acquiring and agency banking channels separately, despite often being served by the same micro or small business (MSME) entities. By amalgamating these channels into one offering, banks can unlock a myriad of benefits.

Consolidating channel management not only streamlines operational processes but also fosters cost efficiencies in agent & merchant recruitment, training, and supervision.

Moreover, integrating merchant settlement with agent float accounts in one platform enhances cash liquidity management.

This unified approach boosts the business case for agency banking and enables more tailored product offerings by leveraging holistic data on bank MSME clients.

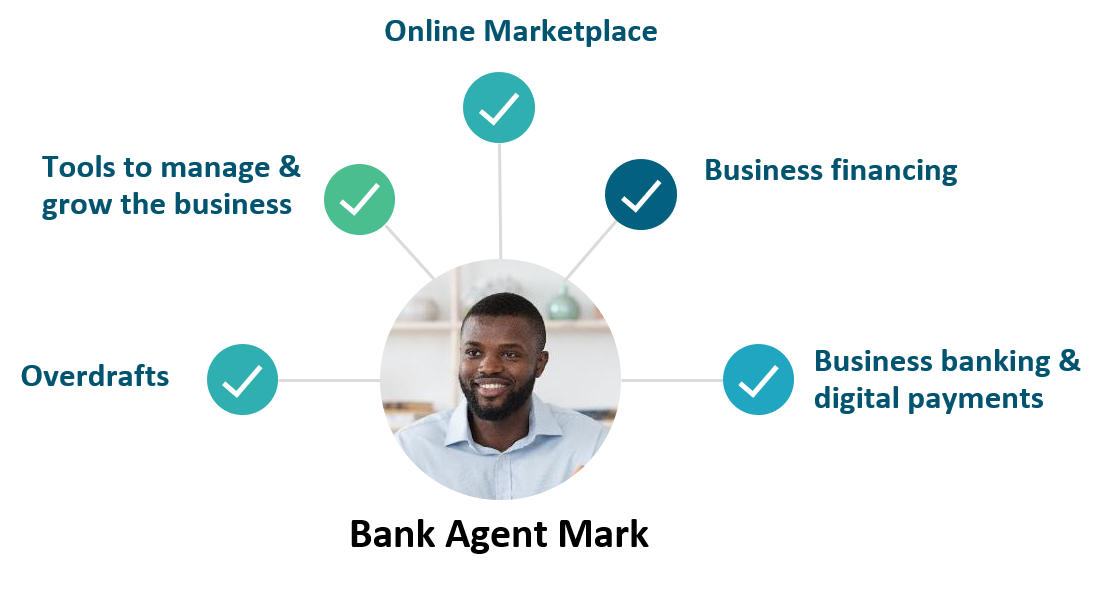

Strategy 2. View Agents as Valued Customers

Shifting the perspective to view agents as valued customers opens up new avenues for tailored financial services and products for the agent.

Banks can extend overdrafts, business financing, mobile banking to MSME agents, and even further value-adding business tools like online marketplaces and business guides, empowering agent growth alongside the bank's.

This approach deepens the relationship with agents and enables banks to gain insights into the business performance of their SME customers.

Strategy 3. Open up the Agent Network to Partnerships

Collaboration is key to unlocking the full potential of agent networks. Banks can leverage the investment in setting up the agent network to provide partner services to the market, beyond traditional banking.

Partnering with various stakeholders enables banks to offer diversified services: for example, agents can assist government agencies with KYC verification services as part of different administrative processes, to the extent allowed by regulations.

Or, by integrating the agent network with national payment schemes, end customers can access a myriad of bills, tax, P2P, and other public and private payments and grants through agents.

Moreover, banks can offer their agent network ‘as a service’ to 3rd-party financial service providers like international remittance companies and SACCOs to provide non-competing services through agents, helping partners reach more markets while earning commissions for the bank.

Such partnerships not only enhance financial inclusion in the economy but also strengthen the overall business case for the agency banking channel.

Strategy 4. VIP Banking Through Agency

In today's fast-paced world, personalized service is the cornerstone of customer satisfaction. By leveraging agent networks, banks can extend exemplary service to VIP customers through door-to-door banking solutions.

Mobile agent apps empower remote staff to serve VIP customers at their convenience, thereby decongesting branches and elevating customer experience.

Assisting VIP clients with account opening, onboarding, loan origination, and various transactions not only saves them valuable time but also strengthens customer loyalty to the bank.

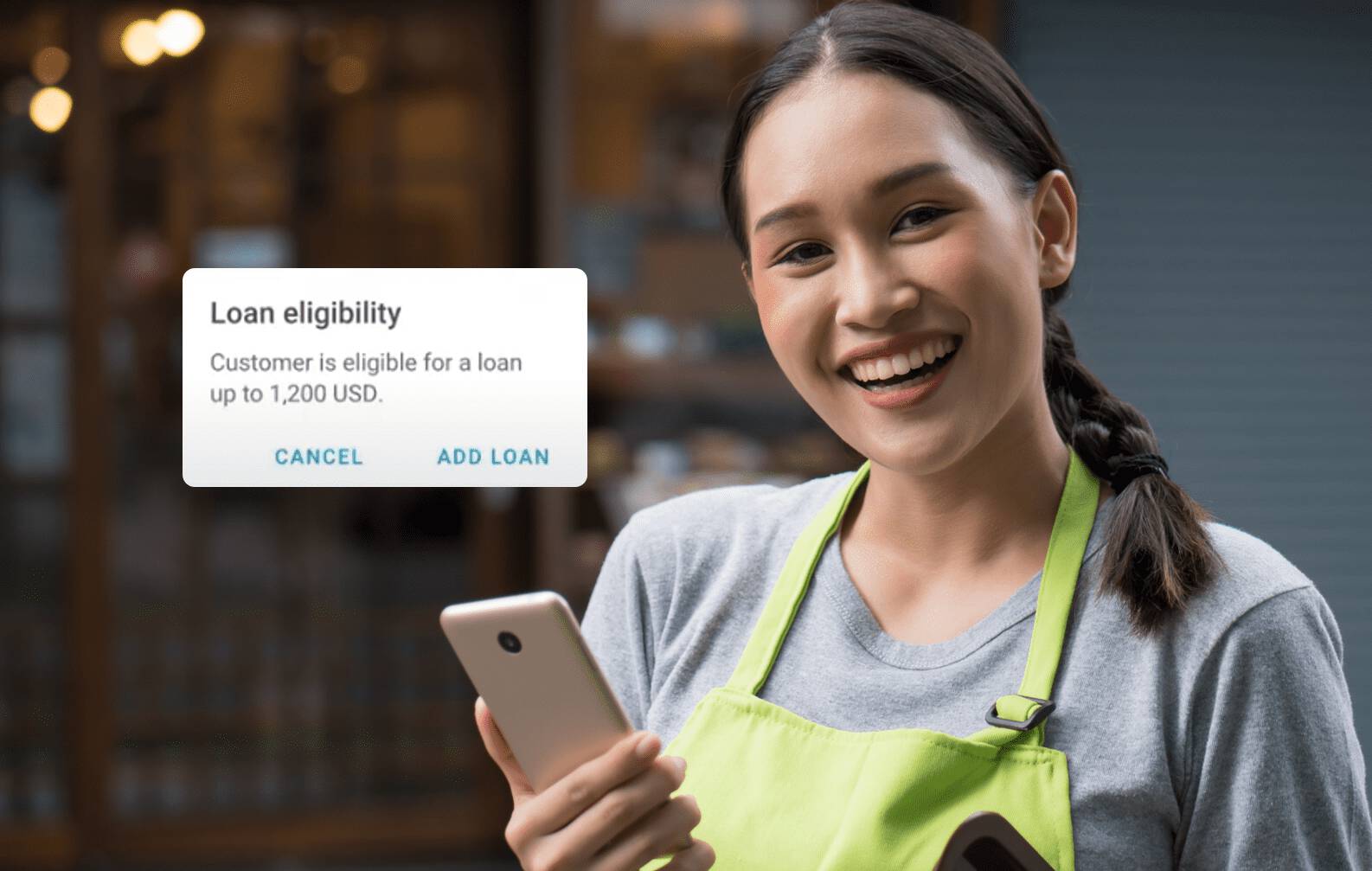

Strategy 5. Distribute Digital Nano Loans and Credit Products through Agents

Financial institutions can also harness their agent network to distribute digital loans and credit products and to capitalize on existing customer-agent relationships and scoring data.

This strategy expands the accessibility of financial products, mitigates the risks associated with traditional lending processes, and increases the potential customer base for credit products.

By leveraging automated scoring technology analyzing both traditional and alternative data sources, banks can develop pre-approved loan offers that cater to the evolving credit needs of their customer base while enhancing the profitability of the agent banking network.

In conclusion, the profitability of agent banking networks hinges on strategic innovation and technological advancement. The tactics outlined in this blog represent a pivotal step towards unlocking the full potential of agency banking.

As technology pioneers in agency banking platforms, we understand the intricacies and challenges of transitioning to what we call Agency Banking 2.0 - a branchless distribution strategy that thrives in the evolving financial ecosystem and leads the way toward greater financial inclusion.

Contact our team today to embark together on the journey towards sustainable growth and innovation in agency banking!