Many financial service providers in emerging markets rely on mobilizing their field staff to engage and interact with clients in the place of work or perhaps in locations that are more convenient for the customer, rather than the customer traveling to a branch.

Employees perform specific tasks such as client acquisition/onboarding, account opening, loan origination, inquiries and in some cases collecting payments and deposits. Traditionally, they rely on paper-based processes to serve clients, which are not only time consuming and resource intensive in terms of end to end service, but also prone to error.

As smartphones and tablets have become more affordable and organisations are digitalizing back office processes, the decision to digitize field operations represents an opportunity to not only improve the efficiency of legacy processes but also to introduce new products and improved services through digital channels.

Opportunities to leverage Digital Field Applications in the financial sector

Digital Field Applications (DFAs) refer to the use of digital tools by field staff and typically encompasses not only the data capture processes but also all workflow associated with the service or product request made in the field.

While many financial service providers (FSPs) seek to innovate with digital solutions that focus on customers accessing self-service channels, there remains a segment of the market and/or specific products that require personal interaction between the customer and FSP.

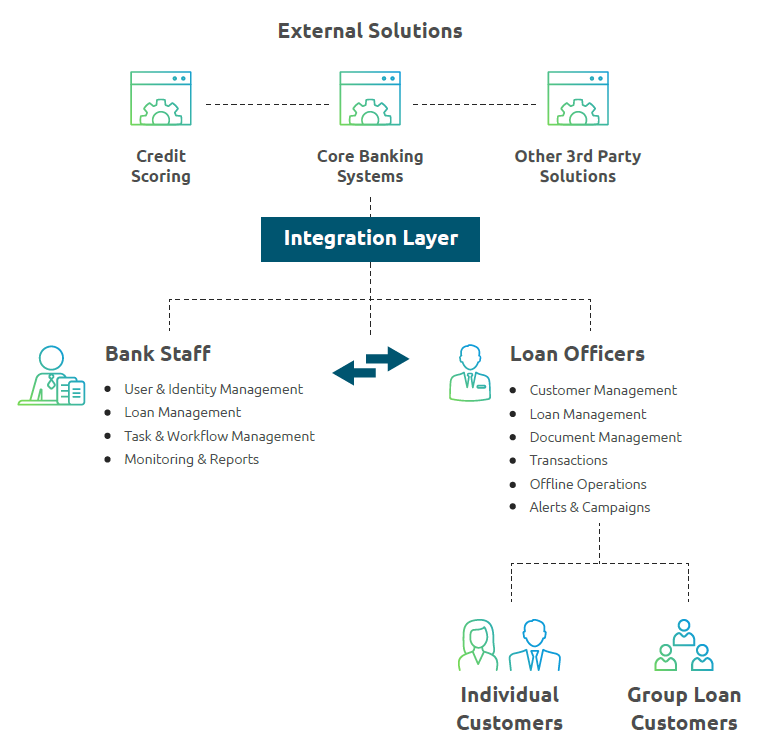

DFA Solution Diagram

While this interaction remains people-intensive, the processes conducted with the customer can be streamlined and automated to address the known bottlenecks and challenges that impact turnaround time, data quality and portfolio management.

For example, in emerging markets where smartphone penetration remains low and/or client literacy levels are not very high, an assisted customer experience is required to guide the customer through the adoption and use of financial services.

Leveraging digital tools such as DFA can facilitate these activities, standardize the capture of information and processes followed and reduce the turnaround time by interacting with the branch or head office in real-time to complete a process such as a loan approval.

Additionally, while some products are well suited to direct engagement with the customer via digital solutions, others such as SME/MSME lending, require extensive data collection and verification in the field.

The efficiency with which clients can access these products can be drastically improved by leveraging digital data capture techniques combined with automated workflow tools and ideally decision engines.

Some of the biggest opportunities for financial institutions include:

- Eliminating paper-based processes for customer onboarding and loan origination. Hence, reducing the errors associated with manual processes and speeding up the turnaround times.

- Increasing staff productivity so staff can handle higher caseloads and ultimately be more profitable.

- Digitizing all client data and building repositories that can fuel automated credit scoring engines in the future.

- Improving customer experience with a convenient service by providing banking “on their doorstep”.

- Introducing new products and services - insurance, automated loan renewals, etc.

- Serving markets further from your branch network by equipping staff with tools that enable them to service clients remotely.

- Digitizing image and document capture eliminating the need for clients to bring photocopies and/or for branch staff to carry out scanning exercises.

- Capturing geolocation of customers (residence and business) to assist with location but also to input to geo distribution analysis.

Download Whitepaper: Field Staff Digitalization -

Download Whitepaper: Field Staff Digitalization - A Decade of Key Lessons Learned in Microfinance

Digital transformation is high on Microfinance Institutions' agenda, but the path to its successful implementation may hold different strategic directions.

Software Group's new whitepaper lays out our business, technological and implementation lessons learned while helping MFIs digitalize their field operations.

Key lessons learned from more than 20 countries

While the opportunities are great, the implementation of DFA does not come without its own share of challenges. Over Software Group's extensive experience implementing DFA solutions in more than 20 countries we can share the following key lessons from the sector:

1. Redesign manual processes to embrace digital

To really leverage the potential of DFA, the FSP will need to take a critical look at its current manual processes and ideally redesign them to embrace the digital opportunities. For many, they seek to just convert manual forms to a digital one but this can often lose out on some of the benefits available from digitization.

2. Address human and organizational change

While organizations focus on the technical elements of a DFA project, it’s the human and organizational change that presents some of the largest obstacles to adoption. Resistance may arise due to fear of job losses once processes are fully digitized and need to be addressed with strong change control from the inception of the project.

3. Make sure your DFA solution can be easily integrated with existing and future systems and devices

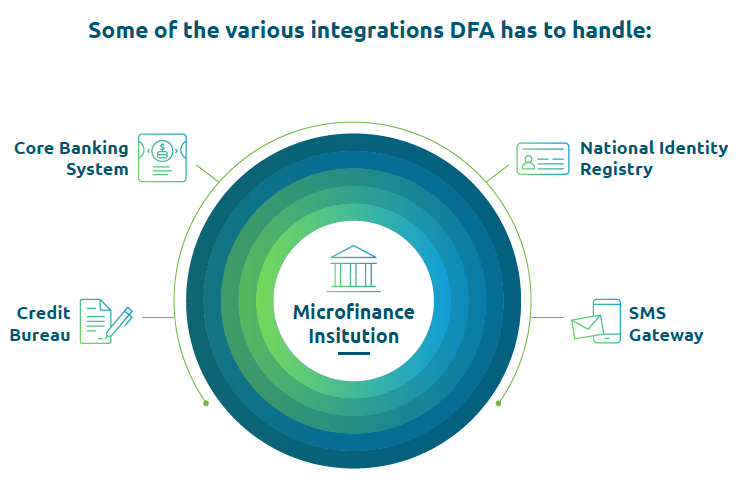

Technical integration to the Core Banking and/or Loan Origination System can be complex. Unlike many channel integrations which typically have a small set of required functionality such as mobile banking, the DFA projects often need access to a wide range of non-financial transactions (customer onboarding, editing customer records, loan application, reporting) for which APIs may not be readily available.

4. Invest in implementation impact analysis beforehand

While many may see DFA as a ‘small’ project by comparison with a CBS replacement/upgrade, sometimes they do not realize the complexity that can emerge during the course of implementation.

Given the need for the solution to be perfectly tailored to the FSPs’ individual products, systems, processes, and market, don’t underestimate the time needed to get these projects right. Investing upfront in the analysis phase to really understand what will/won’t be delivered and how this will impact the day to day operations is essential.

5. Balance custom requirements with time to market.

Considering all said above, an agile or phased approach to deployment is highly recommended with DFA projects. Reducing the time to market will increase the time to value and provide an opportunity to understand user adoption with the flexibility to make adjustments without creating significant delays to solution usability.

6. Start with a pilot and embed the lessons learned

There are many lessons to be learned, ranging from changing processes to managing hardware in the field, and doing so with limited functionality and perhaps with a smaller user group can really benefit the overall success and adoption of the solution.

In our experience, starting with customer onboarding/ account opening is a much easier journey compared with loan origination which very often requires many different processes for each product and scenario. Keep it as simple as possible to start and embed the lessons learned into the whole processes.

How can Software Group help you achieve success with digitalization?

Software Group has been driving digital transformation for 200+ financial service providers across the globe. We have been developed and implemented Digital Field Applications (DFAs) in more than 20 countries around the world, particularly for microfinance institutions.

If the digitalization of field services is on your agenda, please do not hesitate to contact us. We'll be happy to help you with our best practices and technology solutions.