“Software is eating the world” - this was the famous phrase back in 2011 from Marc Andreessen. Now every enterprise company is a software company. Banks too are part of this trend.

The advances in customer experience, provided by the leading tech and design firms like Apple, Google and Microsoft, are driving the entire enterprise sector to up their game in how their services interact with the customer. Microsoft, Google and Walmart have shown that “when you focus on the customer, great things happen”. The trend is also known as the “consumerization of the enterprise”. This, of course, impacts the digital channels for all consumer banks and financial institutions. Banks have one more reason to focus on the customer - the fintech industry. Fintech companies were the first adopters of the customer-first patterns in financial services and are gaining traction very fast.

IT infrastructure problems are becoming dangerously common among big banks. According to Which, at least one UK bank suffered an IT failure every day during the last three quarters of 2018. TSB’s outage, which left nearly 2M customers locked out of their accounts and cost the bank £330M, demonstrates how problematic these IT issues can be to both banks and consumers.

But how “customer-first” relates to microservices architecture you may ask?

Being customer-first requires certain changes in the way a company delivers value to its most precious asset - the customer. It requires a change in the internal operations of the company - how software is planned, created and delivered. Until recently, the banking industry had made it a habit to update software rarely - for example, once a year. But new initiatives are coming along all the time, so in today’s world much frequent release cycles are required.

Small changes are easier to absorb than big ones, and once the team gets into the rhythm of making those small changes, they become less disruptive.

Banks also have to make sure that what they are building now will not become a legacy in the future. They have to build the software with the knowledge and mindset that it’s going to change.

Here is how microservices architecture can help accelerate time to market

But what is a microservice in the first place?

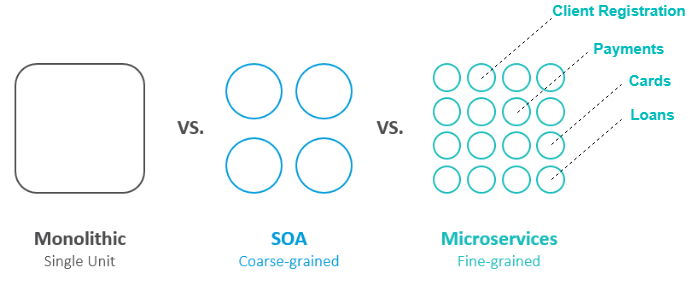

I like how Red Hat are describing microservices: “Microservices are both architecture and an approach to writing software. With microservices, applications are broken down into their smallest components, independent from each other. Instead of a traditional, monolithic approach to apps, where everything is built into a single piece, microservices are all separated and work together to accomplish the same tasks.”

The microservice architecture allows the continuous delivery of large and complex software applications. It also enables an organization to innovate on its technology stack.

Before microservice architecture, systems were often monolithic applications. This could not guarantee that a change in one place will not affect the system in another (often unknown) place. Monolithic applications required many dev-test cycles which was eating a lot of time and was a deal breaker if fast delivery/deployment was needed.

The next evolution in software was when a layered approach was introduced - basically, the application was separated in different layers that could be changed and evolved separately from each other. This made the iteration time much shorter compared to the monolithic approach, but still not enough for quality daily deployments.

Microservice architecture, together with proper DevOps practices for staging and deployment is the beneficial setup that enables you to make fast software iterations from a prototype to a live version.

In conclusion

Today’s customers choose their banks by the customer experience it can offer. In a digital world, only the companies that are digital-first and customer-first can survive. Software Group has a 10-year expertise in driving financial service digital experiences and we are now working on the 3rd iteration of our Digital Banking Platform through the adoption of the above-described microservice architecture principles. By using our platform you can now enable your designers, software developers, marketing specialists and business managers to work together and to deliver the business value your customers expect - in an unprecedented fast way to market.

If you are interested to know more about our experience, please contact us.

Sources:

“Revealed: UK banks hit by major IT glitches every day”, Which.co.uk, 2019.

“Understanding microservices”, Red Hat Inc., redhat.com.