Still, some organizations find it challenging to achieve the desired ROI from their agency banking model, especially when operating an agent network for the first time.

Strongly motivated to help banks realize the full potential of agency banking, we have now supercharged our robust Agency Banking Solution with actionable data analytics and business intelligence (BI).

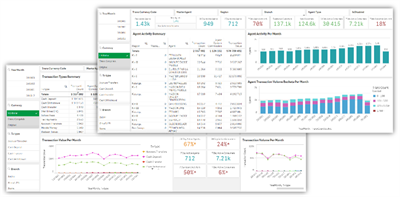

Our new, out-of-the-box Agent Network Performance Analytics Dashboards include a tried-and-tested set of exclusive metrics and in-depth reports which answer critical operational questions and help organizations to proactively manage the agent network and drive adoption and growth.

Such questions are:

- How to improve agent network profitability

- How to increase agent retention

- How to predict float and manage liquidity

- How to reduce customer attrition

- How to spot agent fraud and more.

Our new Agent Network Performance Dashboards come with exclusive metrics based on collective field experience of 25 years analyzing agent networks over 5 billion digital transactions across 14 different markets.

Let Data Drive the Strategic Decisions Surrounding the Management of Your Agent Network

The positive business impact of our new analytics offering is significant: it arms you with proven, actionable, understandable insights that help you unleash your agent network’s profitability without the need to invest in expensive infrastructure and big data analytics and BI teams.“We have further strengthened our robust Agency Banking Solution to provide key analytics aspects for agent management. The new data analytics and BI capabilities will enable our clients to increase the profitability of their agent business, monitor agent performance, appraise KPIs, utilize real-time data on agent activity and sales, and much more.”Josephine Njoroge, Product Manager Agency Banking, Software Group

What You Can Achieve through Our Agency Data Analytics and BI Offering

1. Agent Network Performance

Improve the profitability and efficacy of your agent network, monitoring agent activity rates, trends of transactions per type over time, agent KPIs, and more.

2. Individual Agent Performance

Measure your agents against targets and identify opportunities for improvement. Monitor commissions, analyze transaction volume per bucket over time.

3. Agent Retention

Increase agent retention and decrease churn through modelling based on transactional metrics. Help agents make more money and drive business to them. Monitor daily agent opening hours and activity and detect inactive agents. Estimate revenue loss from agents that have stopped transacting.

4. Float Prediction

Predict agent electronic float shortfalls and optimize resource allocation. Manage liquidity with ease.

5. Product and Branch Performance

Measure usage and performance trends per branch and product, such as product uptake and repeat usage. Use the insights to limit customer attrition.

6. Suspicious Activity and Gaming

Spot suspicious activity and fraudulent transactions early on, such as fake registrations and split deposits. Evaluate suspicious customers for regulation purposes. Track irregular behaviour and excess profit margins. Monitor any abusive behaviour of transactions.

7. Geo Analytics

Identify new agent geo location hotspots for expansion. Track agent activity and make decisions based on geospatial data.

Software Group’s Agency Banking Solution is one of the most developed in the market, and the first Agency solution recognized by leading analyst firm Celent. Proven to cater to the needs of some of the biggest Tier 1 and Tier 2 banks, it equips organizations with everything they need to quickly launch, manage, and scale a successful agency banking network.

Now, with the addition of powerful out-of-the-box Agent Network Performance Analytics and BI, it takes agency banking to an even more advanced, data-driven level.

Ready to realize the full potential of your agent banking channel through data?

Contact us for a demo today.