With globalization and changing customer needs, bank customers are increasingly opting for digital channels that fit seamlessly into their busy lifestyles. Мobile banking, digital payment solutions, convenient remote banking accessibility, personalised financial advice, online privacy and security, full control over financial affairs - customer demands keep growing and banks’ failure to respond to them inevitably leads to missed opportunities and dwindling bottom lines.

But how can banks deliver the experiences that customers expect?

There are three main pillars of seamless customer experiences, each enabled by key technological capabilities:

- Omnichannel - enabled by a Digital Banking Platform

- Personalised - enabled by Big Data and Artificial Intelligence (AI)

- Connected - enabled by Open Banking ecosystems

Adhering to these 3 pillars facilitates the shift from a bank-centric to a customer-centric focus, through the use of data to better understand and predict customer behavior, and the opportunity to collaborate with third party service-providers to enrich customer experience.

Seamless Means Omnichannel

Enabled by a Digital Banking Platform

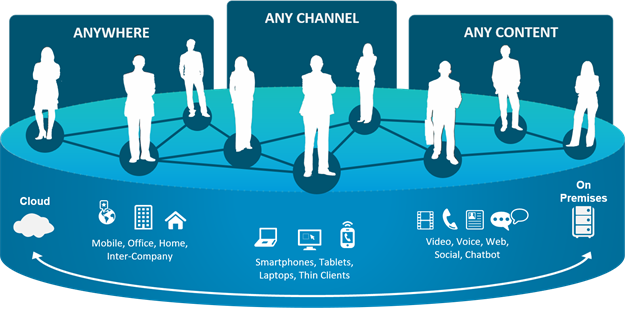

At the heart of customer-centric financial services stand omnichannel digital platforms - central hubs from which, and to which data flows. Platforms provide a holistic view of the customer and allow the centralized orchestration of customer interactions across multiple touch points, following the principle of create once - distribute anywhere. This approach fits seamlessly with the device-agnostic customer lifestyle and empowers data-driven and customer-originated innovation.

By contrast, traditional channel-specific solutions offer limited flexibility, are hard to adapt to changing environments, and lack centralized management of customer data.

In a digital-first world where customers anticipate seamless and consistent experiences across interaction points, the traditional approach is outdated and ultimately unsustainable.

Digital platforms not only facilitate omnichannel interactions, but they also bring significant cost savings as well as more efficient use of IT systems. The main enabler of this approach is the integration of data silos, systems, channels, products, processes and infrastructure into an end-to-end enterprise digital banking platform which decreases the dependability on the core banking system.

Software Group’s DigiWave Digital Banking Platform is a mature and scalable platform which allows banks to deliver seamless end-to-end digital banking experiences, centered on the modern customer. It connects and transforms your business into a digital bank. What’s more, it provides a unified 360-view of customer behavior across channels which facilitates better predictive analysis and helps identify opportunities for both cross-selling and upselling.

Seamless Means Personalised

Enabled by Big Data and Artificial Intelligence (AI)

While AI gives banks a powerful competitive advantage, its implementation in banking has long been hampered by the uncertainty about its security, unclear use cases, and fear of failure. AI is expected to give banks the ability to deliver highly personalised experiences, to enhance customer engagement, and achieve productivity gains through automation. By 2030, traditional financial institutions can cut 22% in costs thanks to AI, according to Autonomous Next, where almost half will come from reductions in the scale of branch networks, security, tellers, cashiers and other distribution staff in favor of AI-enabled interactions1.

"When companies do customer engagement really well, very good things happen, including a fourfold growth in top and bottom line growth, and a threefold increase in customer acquisition"2.

So, could any financial institution, determined to stay in business, afford to overlook the future of customer interactions?

AI in banking can improve communication both internally and externally with features such as robo-advice, robo-ops, chatbots, interactive voice response, image recognition and identity verification. Even at these early stages of AI adoption in banks, the benefits are impressive. Robo-advice can help cut customer service costs by 40%; robo-ops can decrease customer onboarding time significantly. And conversational AI (chatbots) offer a mix of both live conversation and speed, which are becoming top preferences for consumers3.

For AI to work for banks, though, sufficient amounts of usable customer data have to be accessed, collected and managed. Here’s where enterprise digital banking platforms come into play - connecting customer data across systems into centralized data warehouses which is a prerequisite for big data-enabled analytics and AI strategies. The ability to answer certain questions about existing and potential customers based on actual, customer-driven data helps banks to better estimate and determine key profitability metrics, such as customer lifetime value (CLV). Data can be leveraged to improve the return on investment from marketing campaigns and sales tactics through highly targeted customer segmentation, customer sentiment analysis and more.

Seamless Means Connected

Enabled by Open Banking Ecosystems

Collaborative open banking ecosystems can be leveraged to further enrich the customer experience. As much as 52% of banks believe that open banking will be a necessity to securing a competitive advantage4. Banking data is shared through APIs between two or more unaffiliated parties to facilitate the delivery of value-added financial and non-financial services.

For banks, some of the benefits of open banking include the creation of new revenue streams through the monetization of APIs and the generation of new collaborative business models. For the end customer, open banking will enable connected plug-and-play financial services, where customers will have the final word, choosing the superior personalised experiences for their convenience and security. Banking will become embedded into the everyday lifestyle of customers, and growingly integrated within non-financial activities.

In the European Union, PSD2 (The Revised Payment Service Directive) is a game changer for open banking. PSD2 enables bank customers to use third-party provider services to manage their finances. These could include other banks, fintechs, insurers, retailers, telecoms, wealth managers. Banks are obligated to provide access to raw account data (together with transaction history and balances) through open APIs. According to Deloitte, the bank of the future would most probably be a marketplace bank - a platform-enabled ecosystem of financial and non-financial services and activities5. To win in the marketplace, it would be crucial to truly understand customer needs. Only then can providers improve their offerings to customers.

48 percent of consumers want banks to play a role in the purchasing process for non-banking products6. The reason - modern customers appreciate complete customer journeys. So extending banking with home, auto, travel and more non-banking services in a convenient manner offers banks a distinctive advantage over not-so-well connected competitors.

Investing in digital is a must in today’s rapidly changing environment and customer experiences should be at the center of any bank’s digital strategy. To respond to customer expectations adequately, banks need to make sure that they offer seamless customer experiences across touchpoints - experiences that flow omnichannel, deliver personalised service and are connected to the consumer’s ecosystem. Delighting customers, in turn, is one of the shortest paths to becoming a digital leader.

Sources:

- “Augmented Finance & Machine Intelligence”, Autonomous Next, 2018.

- Forbes Study, Customer Engagement: Best of The Best, “How AI Refocuses Your Business On The Customer”, Whitepaper From Finextra, Produced In Association With Pega, 2018.

- Rashed Haq, Conor Ogle, “Can Banks Get Smarter? Rethinking AI In Financial Services”, Publicis Sapient.

- “Accenture Research: Most Large Global Banks Planning Major Investments In Open Banking”, Accenture, 2017.

- “Open Banking. How To Flourish In An Uncertain Future Report”, Deloitte, 2017.

- “Beyond Digital: How Can Banks Meet Customer Demands?”, Accenture.