Until recently, insurance companies could carry on providing standard products and services, utilizing traditional channels without having to worry much about compromising growth and customer satisfaction.

However, as consumers are pampered with connected experiences and a united, digital journey across industries, it is easier than ever to lose clients with outdated, rigid, and detached channels and poor user experience, and insurance is no longer an exception.

The needs and desires of the modern-day insurance customer

There is a vivid call for a digital future in the insurance sector and it can easily be traced by the growing trends in customer digital preferences (based on 2021 research by Capgemini & Efma, Accenture):

- More than 80% of customer interactions with insurance firms were digital in 2021.

- >50% of customers would buy insurance from BigTechs and other non-traditional players.

- >70% of customers expect a multi-channel experience for policy research and purchase.

- 7 out of 10 consumers would share personal data on their health, exercise and driving habits in exchange for lower insurance prices, an increase of 19% from two years ago.

- >40% find it challenging to contact agents and brokers outside typical office hours.

What these numbers reveal is that customers are looking for insurance providers that offer an experience and service similar to that of Big Tech companies. A disconnected experience is easily spotted.

But how can insurers accelerate their shift from traditional product-centric propositions to customer-centric digital experiences?

The answer lies within digital platforms as the enablers of this transformation. By implementing digital platforms, insurance companies can digitize and integrate the full insurance lifecycle end-to-end, elevate agents and brokers, and create connected digital insurance customer journeys across channels, legacy systems, and silo departments.

What makes a digital insurance customer journey stand out

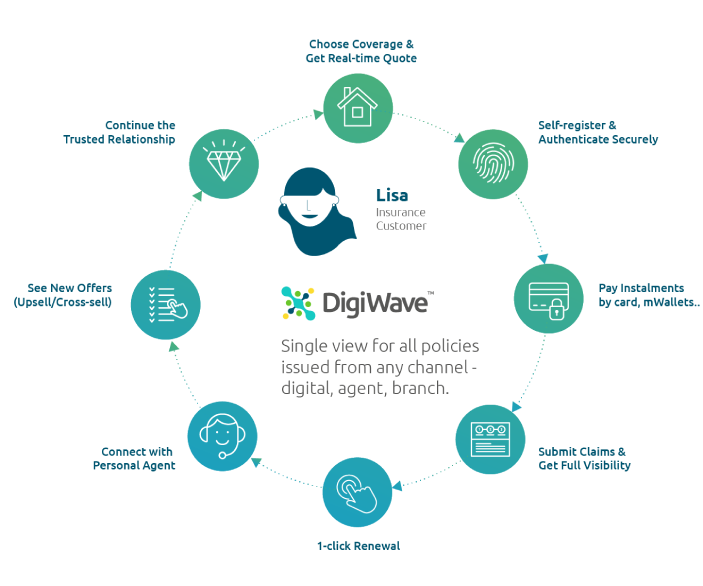

A truly connected digital insurance customer journey is at the core of future relationship building and attracting new customers. It starts from the moment a customer seeks to buy an insurance policy to claim registration, policy renewal, and upgrades to other products and services.

A best-in-class experience stands out with a few core elements:

- Customer self-service capabilities

- Instant digital claims processes directly integrated with claims ecosystem partners

- Ability to choose the preferred channels of interaction

- A 360 central view of the relationship with the insurer, regardless of the used channels - broker, agent, online, mobile app

- Professional guidance on product suitability

- Diversity of available payment methods

- Ease of use

- 24/7 access

- Full transparency

- Personalised up-sell/cross-sell offers

- 1-click renewal and policy management

And more!

By adopting a modern omni-channel digital platform approach to insurance, companies can automate and speed up key phases of the sales, claims, and policy servicing processes. This helps reduce service costs, frees up staff time, and changes the strategic focus to earning long-term customer loyalty and increasing customer lifetime value.

Clients can enjoy benefits like interactive quoting tools, automated online policy purchases, digital customer IDs, digital claims submission and transparent tracking, digital payments, accessible dashboards with alerts and notifications to help them not miss important events, chatbots, and others.

Agents and brokers, in turn, can provide faster response times and more convenience thanks to a 360 view of the customer and digital sales & communication tools.

A further added value of the holistic platform approach is that insurers can take advantage of the collected data across channels to create offers that have been personalized based on customer needs.

Digital platforms as the enabler of customer-centric strategies on top of legacy systems

Simply put, a Digital Platform is a user-friendly, smart layer on top of core insurance systems that speaks to them seamlessly behind the scenes. It enables insurers to get the digital advantage now, while saving Capex & Opex in core system upgrades.

The platform transforms insurers into agile and customer-centric organizations, helping them save costs, increase speed to market, reduce risk, and improve efficiency by more than 30%.

But also, а Digital Platform is a ticket to the ecosystem future - insurers can easily build new propositions on it to respond to newly arising market needs and opportunities, including ecosystem-driven models like ‘connected insurance’ and ‘embedded insurance’.

How a Digital Platform drives your digital roadmap:

1. Omni-channel customer engagement

For an exceptional connected experience, physical and digital channels should be flawlessly integrated and blended, along with all relevant data. This enables omni-channel customer engagement and allows you to increase the productivity of your workforce and distribution channels via digital tools.

2. End-to-end process optimisation

Back office processes need to be digitized, optimized and automated. One of the biggest challenges in achieving this goal is the complexity of changing legacy systems. However, thanks to a Digital Platform, you can benefit from a smart layer that functions on top of core insurance systems, working towards creating a truly digital insurer.

3. Product innovation

Along with the improvements and digitization of the customer journey and internal systems, product innovation should also be factored in. Having a digital mindset and modular platform building blocks allows you to launch new products to market quickly, ahead of competitors.

4. API-driven Ecosystems and the future

Finally, to guarantee smooth operations and ongoing innovation, it’s vital to connect to partners and third parties in the ecosystem and make use of technologies like IoT, AI, virtual assistants, RPA, analytics, and more. The Digital Platform makes it possible to maintain open APIs, a modern technology stack, and integration capabilities that enable continuous innovation and partnerships for growth.

Make the right steps towards a digital future

What was once considered a digital “future” is now part of the ongoing global change.

What is the next step in your digital journey?

Get the digital advantage now and keep pace with change with our future-proof Digital Insurance Platform and ready-made digital self-service portals for customers and agents.

No matter where you are on your digital journey, we’re here to help you position for success today and tomorrow.

Sources:

Capgemini, Efma, World Insurance Report 2021

Accenture, Guide insurance customers to safety and well-being, 2021